Our Best Client is an Educated Consumer!

At Livingston Collision, Inc. we believe in providing our clients with over six decades of experience and knowledge to help them fully understand their damages and what is required to attain a proper and thorough repair at a fair and competitive price. Equally advantageous when navigating through an insurance claim is to provide you with the available information to ensure you receive your full entitlements.

After sustaining damage to your vehicle, it is important for you to fully understand the rights and obligations you have as a consumer. We too are consumers and as such, we understand that having sustained an unexpected loss and navigating a claim for related damages can be very stressful with many decisions that must be made in a short period of time. At Livingston Collision, we work with all insurance companies. However, once your vehicle is placed in our trust, We Work for You to provide you proper and thorough repairs, with quality parts and materials needed to not only restore your damaged vehicle… but to also restore you and your family’s Peace of Mind.

As such, Livingston Collision has devoted this portion of our website to provide our community members with readily available information to help safeguard yourselves from insurer abuse or to be taken unfair advantage of regarding the repair of your vehicle. Knowing your rights is your best protection to ensure that you receive what is called for in your time of need.

Read and see below to learn more about what rights you may have:

Knowing Your Rights as a Consumer

Is the first step in obtaining a proper and thorough auto repair and settlement.

When confronted with an auto accident you want your life back in order and your means of transportation repaired properly or replaced as quickly as possible. Before you begin the vehicle repair process it is particularly important to know what rights and considerations you may be entitled to so that you may protect and assert them and not lose or forfeit them.

To begin, reading the nationally accepted Auto Repair Bill of Rights can help guide you through the repair or replacement process. It will also provide you with the knowledge to build a good relationship with your chosen auto-body repair shop and protect you from possibly being harmed further by others who may place their interest before yours.

Consumer’s Auto Repair ‘Bill of Rights’

Basic Rights:Your Vehicle…Your Choice!

- You have the right to select the repair facility of your choice.

- You have the right to genuine, original equipment manufacturer (OEM) quality replacement parts.

- You have the right to a guarantee that your vehicle will be repaired to factory specifications and tolerances.

- You have the right to a guarantee that your vehicle will be repaired to factory specifications and tolerances.

- You have the right to a local Actual Cash Value (ACV) retail market valuation if your vehicle is determined to be a total loss.

If you were not the cause of the accident, you may have additional rights from the at-fault party and/or their insurance carrier including, but not limited to:

- The right to a temporary substitute vehicle of like, kind and quality to your own, at no cost to you, or to receive compensation for the ‘loss-of-use’ (the cost of a suitable replacement even if the actual costs of same is not incurred).

- The right to recovery of any paid deductibles and/or betterment charges that may be assessed and/or incurred.

- The right to recover the remaining diminishment (loss) of your vehicle’s value.

Choosing a Collision Repair Facility:

The selection of a quality repairer (one which works for you and NOT The Insurer) is the most important decision you can make regarding the proper and thorough damage analysis and repair of your vehicle.

The likelihood is if a collision repairer provided you this information, they are likely a pro-quality repairer who regularly provides a high degree of service and quality workmanship and who backs their repairs with a long-term or “lifetime” warranty. An informed consumer is a quality repairer’s best customer!

Don’t Make the Mistake of Getting Three Estimates!!!!

Oftentimes people believe they must get three estimates: While this used to be common practice, in today’s age of technologically advanced vehicles this is not recommended.

Suppose you do get three estimates and submit them to the payer (the at-fault party, yours or their insurer), care to guess which one they’ll likely elect to pay? If you guessed, most likely, “the cheapest one” you would be correct!

Cheaper is Never Better… And Better is Never Cheaper!

You probably don’t want to entrust your valued investment or the safety of you and your family to the “cheapest” shop in town!

Remember: When it Comes to the Personal Safety and Economic Wellbeing of You and Your Family, Thorough and Proper Repairs are Not Expensive… They’re Priceless!

We recommend consumers seek referrals and recommendations from those they trust and respect and then visit the suggested repairer(s) and interview them just as one would in making any other important financial decision.

Only when you have made your decision, then, and only then, request a written comprehensive estimate/Repair Blueprint of required repairs which promises to restore your vehicle to its pre-loss condition to the best of human ability. This estimate/Repair Blueprint should then be presented to the paying party as your claim and demand for damages.

Note: Understand that an estimate is just that, an estimate and therefore it’s not uncommon for additional and hidden damage to be discovered only after repairs are undertaken. For this reason, be cautious that the at-fault party or the insurer understands that additional damages and costs may not be forthcoming until such time as all repairs are properly completed to your satisfaction!

The Sign of a Good Repair…Is No Sign at All!

It’s Your Vehicle, It’s Your Choice!

Beware of being STEERED! Many insurance carriers attempt to direct or strongly encourage (“steer”) the use of specific auto-body repair facilities (both independent and new car dealerships). These chosen shops have agreed to participate in the insurer’s developed ‘Direct Repair Program’ (aka Direct Referral, Preferred Vendor, Select Service or DRP). These participating ‘DRP’ shops, in exchange for direct referrals by the insurer, often agree to labor and parts discounts and other concessions such as agreeing to expedite repairs to minimize the insurer’s other loss related costs such as rental car expenses. In some programs, if the repairs are not completed within a specific time limit, as determined by the insurer, the program shop is obligated to pay the added rental costs! This of course causes the repairer to rush the repair to avoid a further loss in already discounted profits.

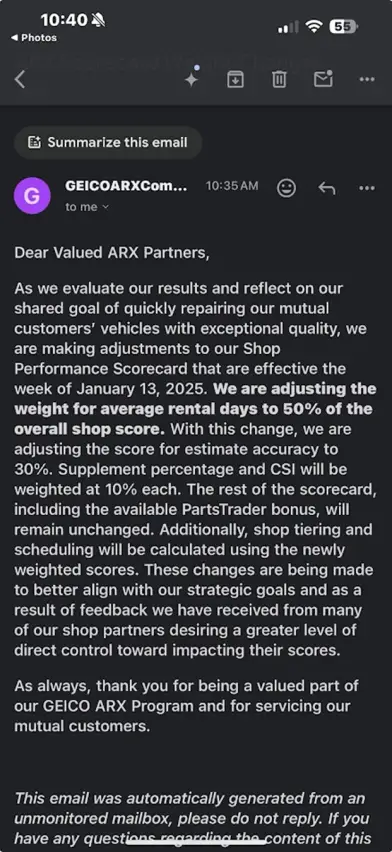

In only January of 2025 – GEICO’s (DRP) Shops had their “Scorecards” adjusted that 50% of their favorable rating is based on their cycle time. That means the faster the shop fixes the car, the more favored they become and the more work they are supplied by GEICO. 30% of their scorecard was weighted for Estimate Accuracy, 10% based on Customer Satisfaction and the other 10% based on cost-containment practices such as parts usage and material costs (assumed).

When it comes to your family’s safety and financial well-being, Livingston Collision prioritizes quality and precision over speed. We take the time to ensure your repair is done right the first time, so you can have peace of mind knowing your vehicle is restored to its safest and most reliable condition.

When it comes to your family’s safety and financial well-being, Livingston Collision prioritizes quality and precision over speed. We take the time to ensure your repair is done right the first time, so you can have peace of mind knowing your vehicle is restored to its safest and most reliable condition.

According to ‘Consumer Watchdog’, a non-profit organization, the group recently stated: “steering can lead to shoddy workmanship and endanger drivers’ safety. So-called “direct repair contracts” between insurance companies and body shops encourage auto repair shops to cut corners in order to save the insurer money and earn a spot on their “preferred provider” list.”

Source: BodyShopBusiness

A further possible downside of these Insurer “DRP” type programs is that they often include a provision mandating the use of less costly ‘aftermarket’ (Non-Original Manufacturer’s, non-OEM) parts and components, many of which do not meet the fit, finish, crash worthiness, safety, corrosion inhibitors and appearance requirements required by the original manufacturer of your vehicle. In many instances, your vehicle’s remaining warranty may be voided using these untested and often inferior parts which fail to properly restore the vehicle or its pre-loss value.

If in doubt, contact your vehicle’s manufacturer and/or your leasing company to determine if the use of these non-original manufacturer “aftermarket” parts will cause you further losses and liabilities (i.e. loss of factory warranty, financial penalties from the lease company, etc.) and place you and your family in harm’s way.

Additionally, these agreements with participating repair shops often include concessions or mandates to avoid charging for recommended or required procedures, such as color matching, suspension alignment, corrosion protection, test driving, and other safety-related processes. These cost-cutting measures may benefit the insurer and their stockholders, but they rarely align with your best interests, as the vehicle owner and operator, potentially compromising the safety and quality of your repair.

A “DRP” shop will likely not bring these issues to your attention in fear of being removed from “the program” by the insurer. A Pro-Quality repairer will keep you advised of such issues and assist you throughout the repair to aid you in protecting you and your family’s safety and economic best interest.

Some insurers have designed some fancy named programs (e.g. “Concierge”) whereas the insurer offers to handle the entire repair for you under the guise of convenience. While this may sound great to the unwary consumer, the fact is you may not even know how your vehicle was repaired or who did it! This is nothing more than entrusting the repair of your vehicle to those who owe the cost of repairing it! A wise man once said:

“Never Take Advice on How to Collect Money from Those Who Owe it to You!”

Insurance companies sell insurance, Collision Repair Shops repair damaged vehicles. You wouldn’t consider buying insurance from a body shop and one shouldn’t seek collision repair advice from anyone other than a trained professional.These insurer’s developed programs are frightening to a quality repairer and should be to every consumer as well! In New Jersey, the choice of repairer is yours, use it wisely.

It’s Your Vehicle, Your Investment, Your Safety and…Your Decision!

Deductibles and Betterment:

Your insurance company is required by law to promptly begin good faith efforts with any licensed repairer you select. If the damage is covered by insurance you are entitled to have your vehicle restored to ‘pre-loss condition’ with respect to safety, function, appearance and value to the best of reasonable human ability; or, in the event of a “total loss”, you are to be compensated for the actual cash (pre-loss) value of your damaged vehicle. If a deductible or ‘betterment’ applies, your insurance settlement may be adjusted by that amount. In the event your vehicle is deemed a ‘total loss’, you may also be entitled to additional compensation for Loss of Use, State Sales Tax and Tag and Title transfer and other applicable costs that the insurer may not freely offer.

Deductibles are part of your contract with your insurer and if applicable will be deducted from your loss settlement and owed by you to the repairer upon satisfactory completion of the repair.

Beware of those who offer to save your deductible as you give them the right to take shortcuts and save money where they can… with no recourse for you! Therefore, you may save nothing, and in the long-run, you may very well lose a great deal more in the loss in value of your vehicle and the safety of you and your family.

Demand the Best, Expect the Best and Only Settle for the Best!

Betterment is the amount the value of your vehicle has been increased (made better) by the repair. It is applied to items that are worn and are usually replaced during the automobile’s normal life-span. For example, if your tires are 70% worn and one is damaged in an accident, it would be replaced with a new tire but the insurance carrier may only pay 30% of its cost whereas you would be responsible for the remaining 70% due to the “betterment” received. Caution should be exercised whereas replacement of some components may require of replacement of its counterpart (i.e. shock absorbers, springs, struts etc.). Check with your vehicle’s manufacturer regarding their recommendations in such issues. Betterment may not be applicable whereas another party was at fault and whereas they or their insurer is providing payment for your repair and/or where the supposed improvement does not increase the vehicle’s value.

Exceptions of these charges may occur if you were not the cause of the accident. In this case the third party carrier should be held responsible for your deductible (if paid), rental vehicle or ‘loss of use allowance’ (where a rental vehicle was not utilized), ‘betterment’ charges as well as any diminution in the vehicle’s value.

Replacement Parts:

As stated above, you are entitled to have your vehicle restored to its “pre-loss condition” to the best of reasonable human ability. The type of replacement parts utilized in the repair can affect the repair as much as your choice of a repair facility. Make sure you know what types of parts are being offered for the repair of your vehicle. A consumer-first friendly repair facility will bring these matters to your attention whereas a DRP shop may not – in fear of being removed from the DRP program or other sanctions from the participating insurer.

Note: Beware of low-quality repair providers who may use low-cost inferior replacement parts or make repair to the original damaged parts even when charging and being paid for new factory replacement parts!

First, there are new OEM (Original Equipment Manufacturer) parts, which are manufactured by and/or for and supplied by the original vehicle manufacturer (Ford, Nissan, Mercedes etc.). These parts meet the same specifications and standards in respect to fit, finish, corrosion protection and crashworthiness as the original parts that were installed on your vehicle when it was built. They also carry the vehicle manufacturer’s warranty.

Second, there are Used, Recycled or Salvaged Parts (also often referred to as “LKQ” or “Like Kind and Quality”). If these parts are undamaged OEM (Original Equipment Manufacturer) and taken from a similar vehicle as yours (the same age or newer with equal or fewer miles), they may be an acceptable lower cost alternative to new OEM replacement parts. The primary area of concern for used OEM parts centers on the required preparation for re-use by the repair facility. In many instances, the cost of labor involved in the “reconditioning” of used/salvaged parts may exceed the cost of new replacement parts which require little if any preparation for their use. Insist that the replacement parts be in as good of condition as your original parts were (not damaged and repaired/repainted etc.). Remember too that these “LKQ” parts come from a donor vehicle that was “totaled” therefore if large sections of a severely damaged/salvaged vehicle are to be employed, ensure that the donor parts are free of damage. Many times, donor salvage vehicles may be totaled due to fire, theft, and flooding as well as substantial collision damages. If all the criteria stated above are met, the use of used or “LKQ” OEM parts may indeed restore your vehicle to its pre-loss condition. For obvious safety related concerns, few truly responsible insurers would call for salvaged suspension components. A pro-quality repair facility will keep you fully advised in this regard as well.

Third, there are non-OEM parts also known as ‘after-market’, ‘quality replacement parts’ (‘QRP’), ‘imitation’, ‘counterfeit’ and ‘offshore Sheet Metal parts’.While some contracts of insurance (policies) state that the insurer may include the use of ‘non-original parts’ that are of “like kind and quality” (“LKQ”) to the parts they are replacing, generally, these “after-market parts’ are not truly of “like kind and quality”, and insurers cannot prove them to be so – and as such, you may not have to accept these cheaper imitations.

Note: Ask the insurer (in writing) for copies of “independent laboratory test” reports stating and substantiating that each individual part has been tested (e.g. “crash tested”) establishing that the called for parts indeed meet the original manufacturer’s tolerances and specifications.

These non-original equipment parts are not made by or endorsed by your vehicle’s original manufacturer. These parts do not undergo the same rigorous tests (including crash testing) and do not carry the original manufacturer’s warranty. Non-OEM/Aftermarket parts have been shown in many cases to have inferior fit, finish, corrode (rust) prematurely, be lighter with fewer welds and may offer dissimilar crash worthiness than factory-approved components. After-market parts may hinder the designed deployment characteristics and performance of your vehicle’s Supplemental Restraint System (SRS/Air Bag) system.

In addition, the use of these un-tested and non-approved parts may void your vehicle’s remaining warranty including any adjacent areas and/or system components that may be affected by their use, should they fail.

It is the opinion of manufacturers and consumer advocacy agencies that the use of non-original and unauthorized aftermarket replacement parts does not restore a vehicle to pre-loss condition and indeed creates a significant question as to safety and the additional loss in value known as ‘Diminished Value’ of the damaged/repaired vehicle.

Before authorizing your vehicle being repaired with Aftermarket parts, it would be prudent to call your vehicle’s manufacturer and/or your leasing agent to ensure these parts are approved and you will face no adverse issues or liabilities such as loss in value at time of trade- in or out of pocket costs at lease return.

Diminished Value (DV) is simply the loss in the market value of a vehicle that has been damaged and repaired. It is an accepted principle that a damaged and repaired vehicle will not command a price equal to one that remains original and has never been damaged. The difference in value will depend upon several factors including the pre-accident condition, history and value of the vehicle, the severity and type of damages sustained (frame and/or structural, flood, fire etc.), and the quality in which the repairs were performed. Diminished value has three separate and distinct causations, which are as follows:

Inherent Diminished Value is the loss to a damaged vehicle’s market value after repairs have been completed. Any vehicle that has undergone a repair because of body/frame and or cosmetic damage is affected regardless of the quality of restoration. When you trade in your vehicle, odds are the dealership will carefully inspect the vehicle and deduct the diminished value from their appraisal. The diminished value may be as low as $100 but can go as high as 80% or more of its retail market value depending on the year, make and model and severity of damage and remaining flaws and defects. In many instances dealers may decline to re-sell your trade-in on their retail lot and sell the vehicle wholesale. Of course, in this instance you would receive less than wholesale so they may make a profit on the transaction. Even if the repairs performed were done to the best of human ability, the mere history of the damage will cause an inherent loss in value.

Claim Related Diminished Value occurs when an at-fault party or insurance company does not allow for the required repair procedures, materials and/or mandates substandard (after-market or poor quality salvage) parts to be used. For example, a car sustains damage to the hood, and the inner structure/radiator support also suffers minor damage. If the insurance company specifies replacing the hood with an aftermarket part and does not allow for the proper repair or replacement of the radiator support, the non-OEM hood and the visible prior damage will both diminish the value of this vehicle. Any such economic loss would become the financial responsibility of the insurer who impeded the repair process. It may become necessary to have re-repairs performed whereas the insurer who failed to address the proper repair initially would be responsible for the re-repair costs, loss of use (rental) as well as the resultant and/or remaining diminished value.

Repair Related Diminished Value applies when a repair facility is paid to perform needed repair procedures and fails to do them correctly. Examples of this may be poor matching paint, remaining flaws and defects in panel repairs, a dull finish, mismatched finish texture, misaligned panels, and many other deficiencies or a culmination of two or more. In these instances, the repair facility and/or insurer may become responsible for the economic loss of diminished value as well as the costs needed to properly re-repair and restore the vehicle.

Total Loss Threshold is the economic point where an insurer decides to consider the damaged vehicle too costly to repair and deem the vehicle to be a “total Loss”. If repaired, the vehicle’s title to be re-designated as a “Rebuilt Total Loss” (Salvage Title) which will significantly reduce the resale value of the vehicle.

A good rule of thumb is that when the damage estimate reaches 80% of a vehicle’s pre-loss market value, the vehicle may be declared to be a ‘total loss’. In fact, with many newer and/or high-end automobiles, many insurers are lowering the threshold to the 50-60% range due to loss related economic factors such as diminished value claims, rental car costs, salvage recovery etc.

Note: New Jersey does not have a set threshold for determining when a vehicle is a total loss. Instead, insurance companies decide if a vehicle is a total loss based on several factors, including the cost of repairs and the vehicle’s Actual Cash Value (ACV) and Salvage Recovery Value.

If your vehicle is deemed a total loss and you seek recovery, you are entitled to a local or regional (if market conditions warrant) Retail Market Valuation to determine its replacement cost or its pre-loss Actual Cash Value (ACV). Insurers often times use computerized reports performed by outside third-party companies who analyze local dealership and private party sales and current availability. These firms compare your vehicle to others which are available or recently sold and prepare a market value adjusted for the options, mileage and pre-loss condition of your automobile.

It is important to realize that the pre-loss condition of the vehicle plays a significant role in a vehicle’s value. Gather all maintenance records, repair bills and improvements you have had performed and forward copies of these to the claim representative, along with a complete description of your vehicle’s options, features and mileage. If you are missing any records the facilities that performed the work should be able to assist you in recreating the vehicle’s service history.

Do not blindly accept the insurance company’s initial replacement settlement offer. Insist that the insurance company forwards you the complete replacement valuation and compare all the details to your own records and research. Call the car dealers, the insurer listed within the report and verify all listed information as factual. There have been many instances where the information provided was incorrect and several lawsuits have reportedly arisen against insurers and their selected valuation companies for possible fraud. If there are any discrepancies, notify your claim representative immediately, in writing!

Google: California DA Sues USAA, Progressive and CCC for undervaluation of total loss vehicles.

California DA sues insurers, estimating system providers over alleged ‘lowball’ total loss payouts

Do your own research or seek a competent expert consultant to assist you. Today’s Internet services are plentiful and provide a wealth of information to obtain book values (i.e. NADA.com, Kelly’s Blue Book (KBB.com) etc.) as well as locating actual vehicles for sale (i.e. Auto Trader.com, Edmunds.com, Carmax.com, etc.).

If you wish, you may seek the services of an independent firm that specializes in performing such services for consumers in this regard including diminished value assessments, pre-repair estimates, in-process repair monitoring, post repair inspections, replacement vehicle valuations etc. Be cautious not to select an independent that provides their services primarily to insurers as there may be a conflict of interest. They may not be able to properly represent your interests in fear of losing the insurer’s regular and long-term business; therefore, they cannot be truly “independent”.

If you are making a claim against your insurer and reach an impasse in settlement discussions, either may elect to invoke the “Appraisal Clause” which is outlined in your policy. You will be required to seek an independent expert appraiser of your own selection, at your expense, as will the insurer at theirs. In the event the two appraisers fail to reach an agreement of the settlement amount, they will then submit their research and findings to an Umpire, of which they selected and agreed upon to make the final and binding resolution and settlement amount. The cost of the Umpire is shared equally between the insured and the insurer.

Conclusion:

Most people are ill-prepared for the unexpected need for auto body repair or know where to turn or who to trust in their time of need. As a result, far too often people take the first advice available to them (insurance claims representatives, insurance agents, tow truck operators, new car dealerships etc.), which may be self-serving and whose intentions may not be in you or your family’s best interest.

Be cautious and be diligent in seeking competent and knowledgeable assistance. The party who made this information available to you is a great place to start since they are likely looking to serve you, the consumer, in obtaining a fair and reasonable settlement of your damages.

This information was provided to enable you to better understand your rights and the opportunity to make the proper selection of your repairer in your time of need. We hope we have enlightened you, and should you have any questions or need additional information, we stand ready to assist you however we may.

Livingston Collision Inc, has been earning the trust and respect of our community members, since 1961…

Livingston Collision Works with All Insurance Carriers, But Once Your Vehicle is Placed in Our Trust…

We Work For You!

Please know that we do not provide discounts or concessions to any insurers which in any way affect the quality of the service or workmanship we provide our customers. At Livingston Collision, we understand that it takes decades to build a good reputation in a community and we will never, under any circumstances, risk losing it or our customers’ confidence!

Livingston Collision Stands Behind Our Commitment of Quality with a “Lifetime Warranty”!

We have and will continue to be a company that views the vehicle owner as our customer. We have and will continue to build our company upon our good name and reputation by earning our clients’ confidence and referrals, one customer at a time. We have found that our most satisfied clients are those that understand their rights and the negative ramifications of insufficient and inferior repairs. Poor repairs are costly in terms of your vehicle’s value at time of re-sale or lease turn-in, and possibly you and your family’s safety.

We all pay for automobile insurance and share a responsibility to keep the costs of repairs reasonable, and while we believe that insurance companies are indeed entitled to earning a fair and reasonable profit, we don’t believe it should be earned at the economic loss of our customers. We will work diligently with you and the insurer to see that your vehicle receives the very best repair available and is repaired utilizing the highest quality parts and materials as needed to properly restore your vehicle…and your Peace of Mind.

At Livingston Collision, We Don’t Just Remove Dents, We Remove Doubts!

Should the need arise, we hope you will consider allowing Livingston Collision the opportunity to demonstrate our commitment to you by selecting us as your preferred collision repairer.

Should you have any questions or need additional services, we would welcome your call or visit.